How to turn birthday money into a Bright Start future

2 Minute Read

From the moment a grandparent holds a grandchild for the first time, they're already dreaming of the future – and maybe thinking about opening a little savings account for a rainy day.

For grandparents (and parents), the future could include watching the child graduate from university, launch a business, start a family, or buy a home. Either way, one thing is for certain: you always want to be right there, celebrating the moment with them.

But what about doing something now to remove financial barriers in the future? With a Bright Start plan, parents and grandparents can put aside a little now that will create the big moments later.

Imagine watching a grandchild accept their university degree in their gown and cap, knowing they're debt-free. Or making a downpayment on a home that you saved for them by putting that birthday money into a plan for the future.

How does it work?

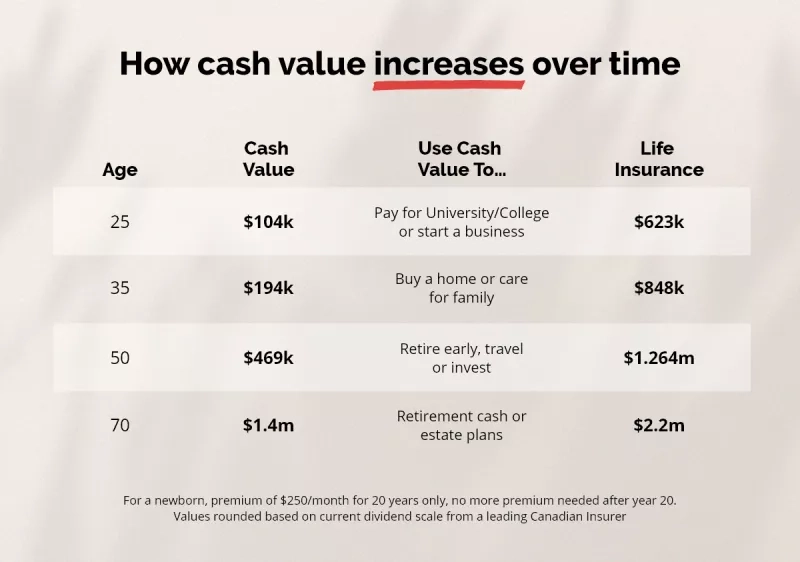

Start with an amount of discretionary income you feel comfortable investing, such as $250 a month over an 8-, 10-, or 20-year payment period.

Over time, the cash portion of the policy builds and returns increase, so that by the time you sign over the policy at the end of the payment period you chose, your child or grandchild will be starting life with a solid financial footing.

At age 25, your child or grandchild could be graduating with a Master's Degree or starting their own business, funded by their Bright Start policy, which could have a cash value of around $104,000, and a life insurance policy of $623,000.*

By the time they are 35 and starting a family in a new home, the policy value could be up to $194,000, plus a $848,000 policy.

Or you could invest in the gift of early retirement or world travel for when they hit 50. By then, Bright Start could contribute around $469,000 to their dreams and adventures (and a $1,260,000 policy).

Make a start with Bright Start

With a Bright Start policy, the cash value builds over time, creating a financial reserve that can be used to cover tuition or the lease on a new business, or pay for their wedding.

And it's flexibly designed to suit your stage of life. Policies can be fully paid off in 8, 10 or 20 years, so when you hand over the policy, your child or grandchild doesn't need to worry about making payments.

Unlike other savings plans, Bright Start policies can be transferred to a child or grandchild tax-free when they reach the age of majority.

Should you need to boost coverage or include some add-ons, Bright Start allows you to add disability coverage, including critical illness, at the start or increase the coverage amount.

Plus, as a policyholder, you have the flexibility to choose how and when to surrender the policy and to pick the coverage based on the premium amount.

Ready to get started on making dreams a reality? Find out more information online or call 1-800-709-5809.

* For a newborn, premium of $250/month for 20 years only, no more premium needed after year 20. Values rounded based on current dividend scale from a leading Canadian Insurer

The cash value is accessible via a withdrawal, policy loan or both and may be subject to taxation. Have a question? To speak to a professional who can guide you to the right coverage from the right insurer at the right price call us at: 1-800-709-5809 Or email us at info@caaprotect.ca