From ancient Rome to a coffee house: The fascinating history of life insurance

2 Minute Read

Did you know modern-day insurance started in a coffee shop? Picture this: a smoky 17th-century London cafe bustling with merchants, shipowners, and business owners, all sipping coffee while brokering deals that would shape the insurance world.

Lloyd's Coffee House wasn't just a place to grab a cup of coffee; it was the birthplace of modern insurance as we know it.

Life insurance has come a long way, evolving through the ages to reflect society's changing needs and technological advancements. From its origins in ancient Rome to the policies we rely on today, the history of life insurance is a tale of innovation and adaptation.

The early days of life insurance

Long before sleek websites, life insurance had its roots in ancient Rome. In Roman society, it was believed that if a person did not have a proper funeral, they would not pass to the afterlife.

Funerals were expensive even then, so the Romans devised a way to manage these costs in advance.

Many citizens joined burial societies, which were the first form of coverage. Members pooled funds to provide a proper send-off for fellow members and ensure their families weren't left with nothing.

Centuries later, in 1688, Lloyd's Coffee House took the concept to the next level. It became the hotspot for merchants looking to protect their ships. Lloyd's began renting out tables where people in business could sell insurance to ship owners worried it wouldn't return.

Life insurance in space

Fast forward to the 1960s, and one of the most unique life insurance stories ever. In 1969, the Apollo 11 astronauts were set to head to the moon.

Before embarking on their 1969 mission to the moon, the Apollo 11 astronauts faced a challenge – acquiring life insurance. Due to the extreme risk of the mission, policy costs were sky-high, making them unaffordable.

With no affordable options available, they devised an alternative plan: knowing that people valued autographs, they decided to sign autographs for their families to sell if they didn't return.

A month before the launch, the astronauts, including Neil Armstrong, went into quarantine and signed hundreds of autographs there.

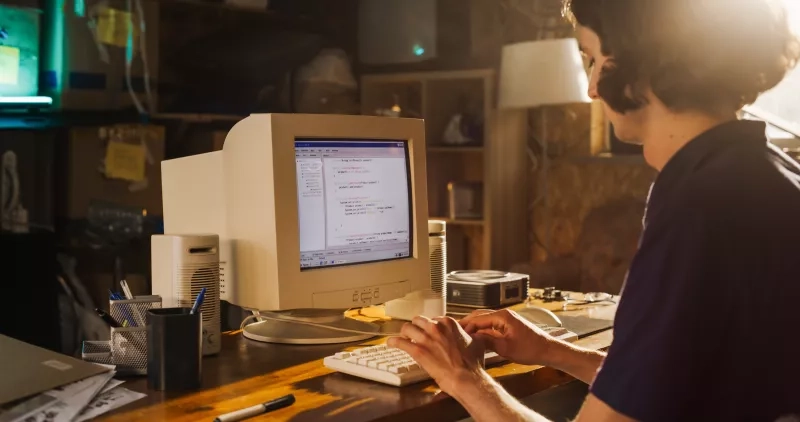

The computer revolution

In the 1980s, computers transformed the insurance industry. Suddenly, people could easily compare policies and pricing – a process that had been tedious and complex before the advent of digital tools.

Complex policies could now be compared and processed more efficiently, allowing for greater transparency and accessibility for customers. With brokers empowered by the new technology, customers benefited from improved pricing options and personalized policy plans.

Life insurance in the digital age

Today, life insurance has fully embraced the internet. Technology has made it easier to protect your family, empowering consumers to make wise, informed choices in just a few clicks.

Need a policy? With CAA Protect, you can compare providers, customize plans, and sign up—all from the comfort of your couch. CAA Protect offers exclusive benefits and personalized support, providing coverage tailored to your needs, all backed by the trusted CAA name.

Book an appointment today to speak with a CAA Protect advisor or call 1-800-709-5809.

Have an insurance question? To speak to a professional who can guide you to the right coverage from the right insurer at the right price call us at: 1-800-709-5809 or email us at info@caaprotect.ca